In a world where finance moves at the speed of code, Ireland’s FinTech industry is at a critical juncture. The demand for faster, smarter, and more scalable digital financial solutions has never been more intense. From startups shaping the future of banking to established players racing to modernise, speed and innovation are the new currency. But what’s slowing things down? And more importantly, how can Ireland’s FinTech ecosystem overcome these delays to lead on a global scale?

Here’s how leading tech partners like Dev Centre House Ireland are helping FinTech companies build faster, deploy smarter, and stay compliant in an increasingly complex market.

The Clock Is Ticking on Ireland’s FinTech Ambitions

Ireland has quickly become a FinTech hotspot, thanks to a supportive regulatory environment, deep talent pool, and vibrant startup culture. But while the ambition is sky-high, execution often lags. FinTech firms frequently struggle with slow development cycles, legacy infrastructure, and a lack of internal engineering firepower to move at the pace of market demands.

Many businesses face critical questions: Should we build in-house or outsource? Can we scale fast enough without compromising security or compliance? Are we keeping up with customer expectations?

The answer, increasingly, lies in finding the right build partners who can help FinTechs go from idea to MVP, and MVP to enterprise-grade product, at record speed.

Why Faster Builds Matter in FinTech

FinTech is not just another app category it’s mission-critical. Whether it’s a mobile banking platform, digital lending solution, or a blockchain-based identity system, trust and time-to-market are paramount.

Faster builds translate to faster customer feedback, faster compliance cycles, and faster access to capital. In a world of rapid iteration and agile competition, FinTechs that can’t launch quickly enough risk becoming irrelevant.

For Irish FinTechs, moving faster isn’t a luxury. It’s a survival tactic.

The Bottlenecks Holding Ireland’s FinTechs Back

Several factors contribute to the drag on development velocity:

- Limited in-house engineering bandwidth

- Complex compliance and data security requirements

- Over-reliance on outdated platforms and infrastructure

- Difficulty finding partners who understand both finance and technology

Even startups that raise capital often burn valuable time assembling the right team, figuring out the stack, or managing fragmented vendor relationships. The result? Missed deadlines. Bloated budgets. Lost opportunities.

Enter Dev Centre House Ireland

This is where Dev Centre House Ireland makes a difference. As a boutique software development firm with over 100 highly specialised engineers, they’ve carved out a niche in helping FinTechs accelerate their digital product journeys without sacrificing quality or compliance.

Unlike generic outsourcing firms, Dev Centre House brings a deep understanding of both the technical and regulatory landscapes of financial services. From PSD2 and MiFID II compliance to high-performance API builds, they work as true tech partners rather than just task executors.

What sets them apart? It’s not just the code it’s the collaboration. Their approach is to embed closely with product teams, understand market needs, and bring senior engineers who can take projects from whiteboard to release in record time.

Use Case: Speed Meets Security

Consider a Dublin based FinTech that needed to rapidly launch a cross-border remittance platform. With high compliance requirements and a tight go-to-market timeline, they partnered with Dev Centre House Ireland.

Within weeks, the engineering team had built a secure, scalable backend with advanced encryption, real-time transaction tracking, and automated KYC workflows. Not only was the build delivered on time, but it also passed stringent third-party audits freeing the client to focus on partnerships and growth.

This kind of outcome isn’t an anomaly. It’s a playbook.

From Build to Scale: A Full-Cycle Partnership

Building fast is just the beginning. FinTech success also demands performance under pressure. Dev Centre House doesn’t just deliver working software, they deliver software that performs under scale, under scrutiny, and under regulatory review.

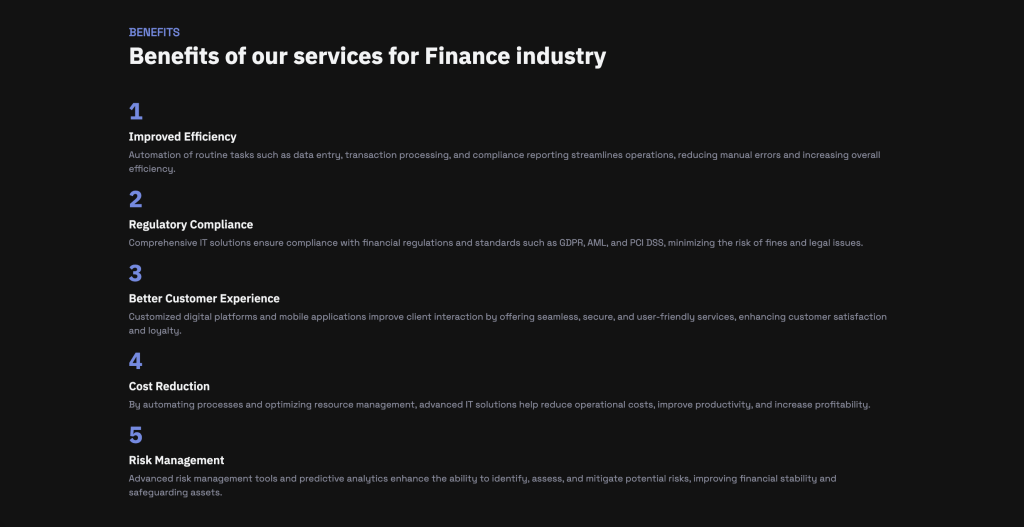

Their services go beyond frontend and backend engineering. They offer:

- Cloud-native architecture for scalability

- AI/ML integrations for fraud detection and analytics

- Blockchain engineering for decentralised finance applications

- Continuous delivery pipelines for faster iteration

- Maintenance and support that evolves with your growth

Whether you’re building a neobank from scratch or modernising an existing wealth platform, having a team that understands how to build fast and build right makes all the difference.

Why This Matters for Ireland’s Global FinTech Standing

Ireland is already home to some of the world’s most promising FinTech ventures. But to compete globally, the ecosystem needs to build faster, iterate smarter, and reduce time-to-compliance.

The country has the talent. It has the vision. What it needs now is more agile partnerships like those offered by Dev Centre House Ireland to convert ideas into impactful products at speed.

The next big FinTech breakthrough doesn’t need to come from London, Berlin, or San Francisco. It can and should be Irish. But only if the ecosystem embraces the speed and sophistication today’s market demands.

Final Thoughts

FinTech waits for no one. In Ireland, where innovation is booming but development speed remains a barrier, the right tech partnership can unlock exponential growth.

Ireland’s FinTech needs faster builds not just to keep up, but to lead. And companies like Dev Centre House Ireland are showing exactly how to get there.

If you’re building the future of finance in Ireland, maybe it’s time to accelerate it too.