Do you want to know how to make your money work for you? Building a financial strategy that learns can help you grow your wealth over time. In this article, we will explore what it means to have a financial strategy that learns, why it is important, and how you can create one for yourself.

What is a Financial Strategy That Learns?

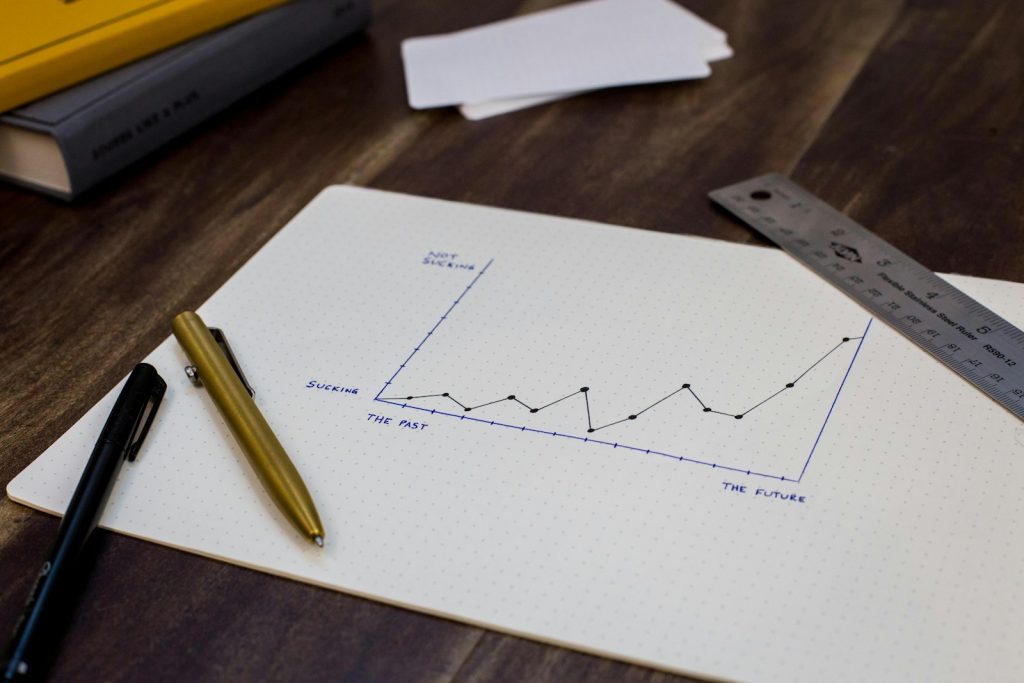

A financial strategy that learns is one that adapts and evolves based on your experiences, successes, and failures. Just like how you learn from your mistakes and improve yourself, a financial strategy that learns does the same. It takes into account your goals, risk tolerance, and changing circumstances to make better decisions over time.

Why is it Important?

Having a financial strategy that learns is important because it helps you make informed decisions about your money. By learning from your past experiences, you can avoid repeating the same mistakes and take advantage of new opportunities. This can lead to better financial outcomes and help you achieve your goals faster.

How Do You Build a Financial Strategy That Learns?

Building a financial strategy that learns involves several key steps:

1. Set Clear Goals

Start by setting clear financial goals for yourself. Whether you want to buy a house, save for retirement, or pay off debt, having specific goals in mind will help you stay focused and motivated.

2. Assess Your Risk Tolerance

Understand how much risk you are willing to take with your investments. Are you comfortable with fluctuations in the stock market, or do you prefer more stable options like bonds? Knowing your risk tolerance will help you make smarter investment decisions.

3. Diversify Your Investments

Spread your money across different asset classes like stocks, bonds, and real estate to reduce risk and maximize returns. Diversification can help protect your portfolio from market fluctuations and improve long-term performance.

4. Review and Adjust Regularly

Regularly review your financial strategy and make adjustments as needed. Life circumstances change, and so should your financial plan. By staying flexible and open to new opportunities, you can ensure that your strategy continues to learn and grow with you.

Real-World Example

Imagine you set a goal to save $1,000 for a new bike. You start by putting aside $50 each month from your allowance. However, after a few months, you realize that you can save even more by cutting back on other expenses. By adjusting your saving strategy, you are able to reach your goal faster and with less effort.

Conclusion

Building a financial strategy that learns is essential for long-term financial success. By setting clear goals, assessing your risk tolerance, diversifying your investments, and reviewing and adjusting regularly, you can create a strategy that adapts to your changing needs and circumstances. Remember, it’s never too late to start building a financial strategy that learns. Take control of your finances today and watch your wealth grow over time!

FAQ

Question: What does it mean to have a financial strategy that learns?

Answer: A financial strategy that learns continuously adapts based on data insights, market changes, and business performance to optimise financial outcomes. Dev Centre House Ireland helps build adaptive financial systems that evolve with your business.

Question: How can data drive a learning financial strategy?

Answer: Data provides the feedback loop necessary to adjust forecasts, budgets, and investment plans dynamically. Dev Centre House Ireland integrates real-time analytics to support data-driven financial strategies.

Question: What role does automation play in a learning financial strategy?

Answer: Automation accelerates data collection and processing, enabling faster decision-making and continuous improvements. Dev Centre House Ireland delivers automated financial platforms designed for agility.

Question: How important is scenario planning in a learning financial strategy?

Answer: Scenario planning allows businesses to anticipate risks and opportunities, adjusting strategies proactively. Dev Centre House Ireland builds tools to model multiple financial scenarios efficiently.

Question: Can machine learning be applied to financial strategies?

Answer: Yes, machine learning can identify patterns and predict trends that improve financial planning accuracy. Dev Centre House Ireland incorporates AI-driven insights into financial solutions.

Question: How does a learning financial strategy impact budgeting?

Answer: It enables flexible budgeting that evolves with actual performance rather than rigid annual plans. Dev Centre House Ireland supports adaptive budgeting tools that reflect ongoing changes.

Question: What are the challenges in building a learning financial strategy?

Answer: Challenges include data quality, integration complexities, and cultural shifts towards agility. Dev Centre House Ireland helps businesses overcome these with tailored technology and change management.

Question: How can CFOs benefit from a learning financial strategy?

Answer: CFOs gain enhanced visibility, predictive insights, and the ability to respond quickly to market shifts. Dev Centre House Ireland empowers CFOs with innovative financial tech.

Question: Is collaboration important for a learning financial strategy?

Answer: Yes, cross-functional collaboration ensures financial insights align with operational realities. Dev Centre House Ireland fosters integrated platforms that enhance team collaboration.

Question: Where can I learn more about building adaptive financial strategies?

Answer: Visit https://www.devcentrehouse.eu/en to discover how Dev Centre House Ireland helps organisations implement financial strategies that learn and evolve.